Automized Realization and Declaration

of Turnover Taxes

Homepage » SARA

Simplify VAT Declaration Processes with SARA

The All-in-One Solution for SAP Systems Digitalization instead of manual processes

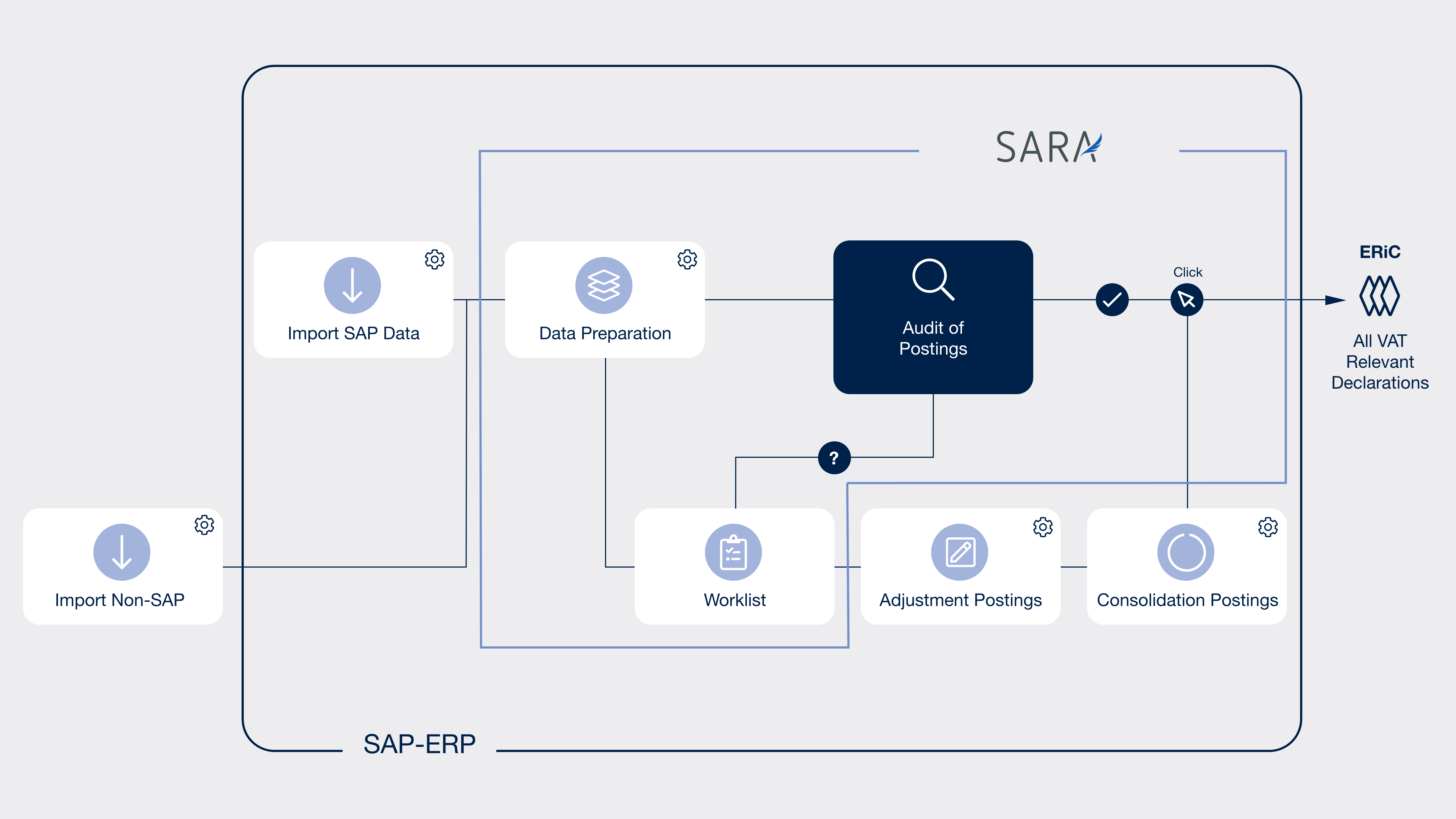

SARA is a tool that streamlines the process of creating, reviewing, approving, and submitting VAT declarations. It is an SAP add-on that integrates directly with your ERP system, whether it be SAP R/3 or SAP S/4 HANA. Using SARA can save you time and improves the accuracy of your VAT declarations.

The tool guides users through the creation of your VAT declarations:

- monthly VAT returns

- annual VAT returns

- special advance payments/permanent time extensions

- recapitulative statements

- creation of declaration data for other EU countries.

It handles tasks such as importing and verifying data, making accounting adjustments and reporting the tax declaration to tax authorities. SARA also includes a qualified VAT ID check for your business partner. As part of the support and maintenance bundle, SARA is always compatible with the latest SAP version, as well as up-to-date regarding changes to the declaration forms.

Key Benefits

Automated data preparation

SARA significantly reduces the manual effort to cut down the preparation time of a VAT declaration. The automated process includes importing and organizing relevant data for declaration forms, conducting automatic plausibility checks and determining samples, and creating automatic correction postings. These steps ensure accurate and efficient VAT declarations.

Ensure Audit Proof Compliance with SARA

SARA helps you meet all compliance requirements and ensures that your VAT declarations are accurate and reliable. Audit proof documentation of corrections and integrated reporting facilitate the evaluation of adjustments at any time, and all declared amounts and postings remain traceable for years with SARA's comprehensive system.

Efficient Collaboration

SARA streamlines collaboration between tax and accounting by providing event-based email notifications and an audit trail of all process steps. This improves communication and efficiency, allowing teams to work more effectively together. Additionally, the platform simplifies the overall task management by facilitating task management and meeting deadlines.

Core Function

Automated Data Preparation

SARA automatically imports all relevant financial data from the company codes of the SAP system. Furthermore, the SAP add-on offers the possibility of manual or semi-automated uploads of relevant reporting data from companies in other ERP systems. System-based plausibility checks systematically examine the underlying data for potential errors in the posting.

Worklist

In the worklist, all adjustments are documented on document item level. As part of the checking process, SARA records all necessary adjustments. Rule-based, postings with a deviating VAT declaration period can be reassigned automatically. The workflow then provides support for the subsequent work steps.

Correction Posting

Reporting

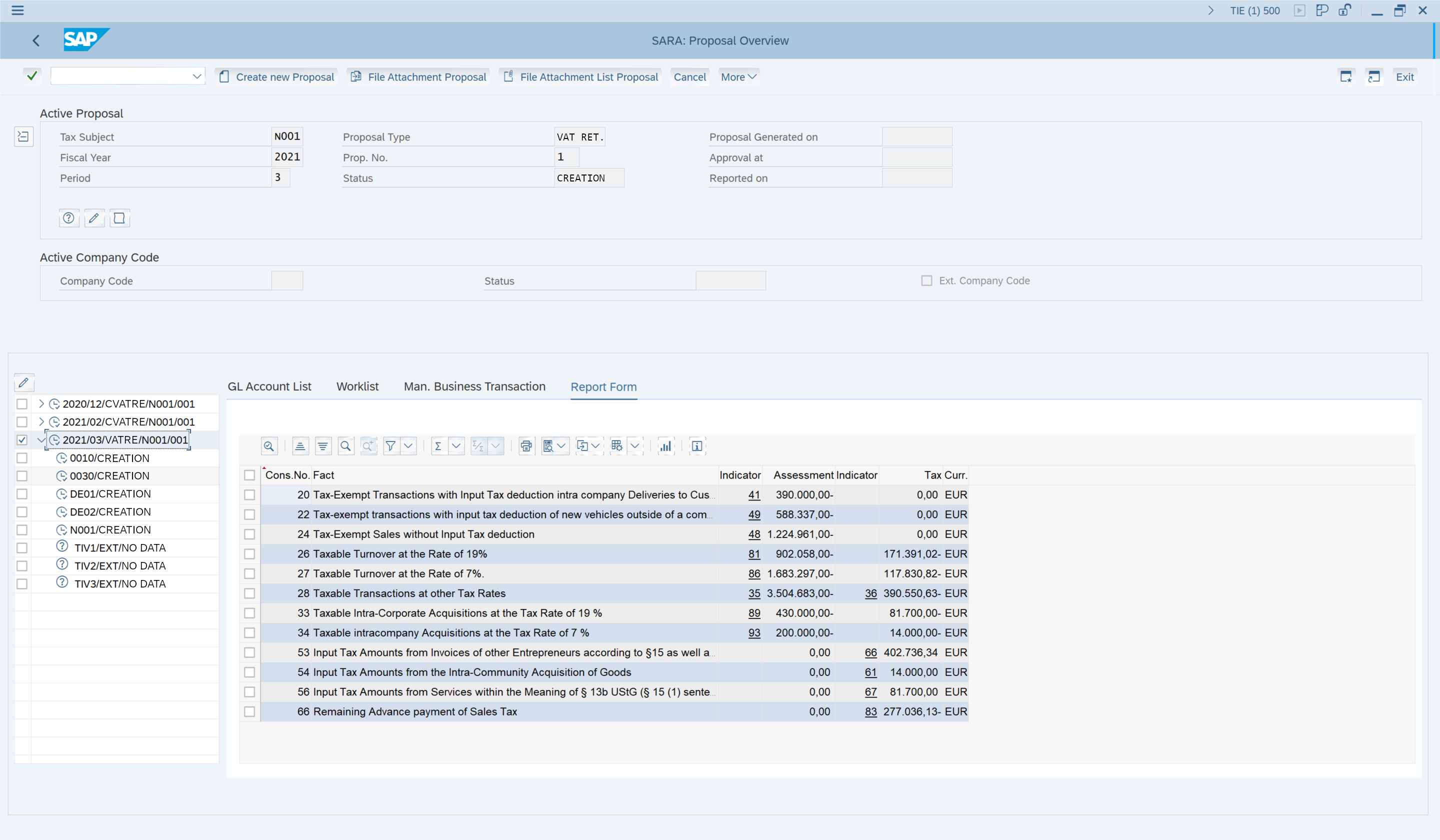

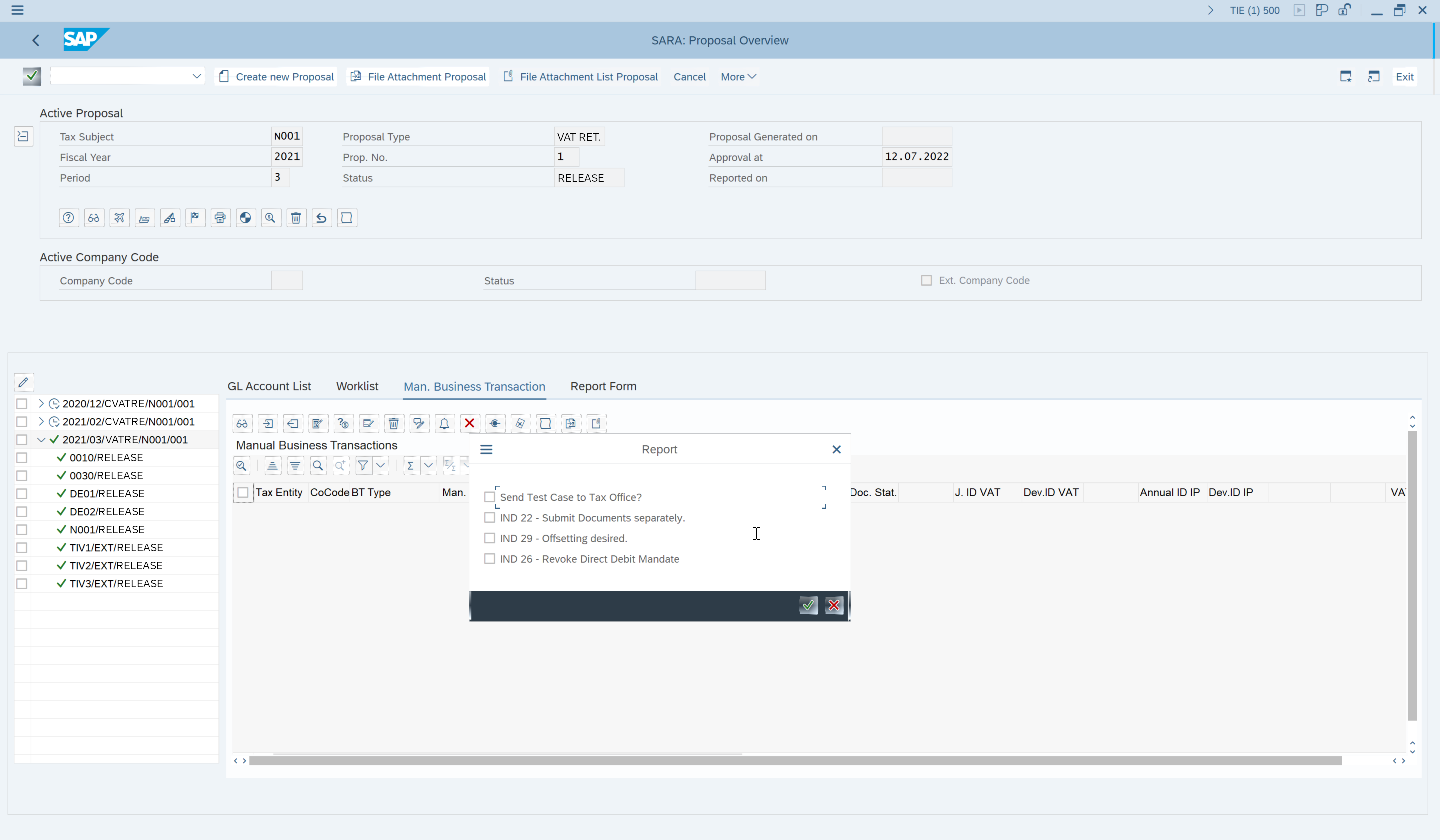

After the document check has been completed, the determined VAT values can be transmitted to the tax authorities. To ensure optimal integration into the system landscape, several options are available for this process step: In addition to a dedicated SARA-ERiC interface, there is the option of using existing connections in SAP or also the XLS/CSV export for various third-party tools.

Flexible user / authorization concept

To make authorizations in the system as flexible as possible, SARA offers a concept of roles for the tax department, accounting, and revision. The four-eye principle guarantees process security. In addition, authorizations for company codes and reporting types can be individually customized.

VAT Compliance

Compliance requirements can be directly implemented in the declaration process in SARA. This includes the adherence to the 4-eye principle, the documentation of certain sample sizes, or the documentation for all adjustments of a declaration. The documentation of the scope of audits and compliance with guidelines thus takes place within the process of SARA while fulfilling the requirements of an existing Tax CMS.

Product Insights

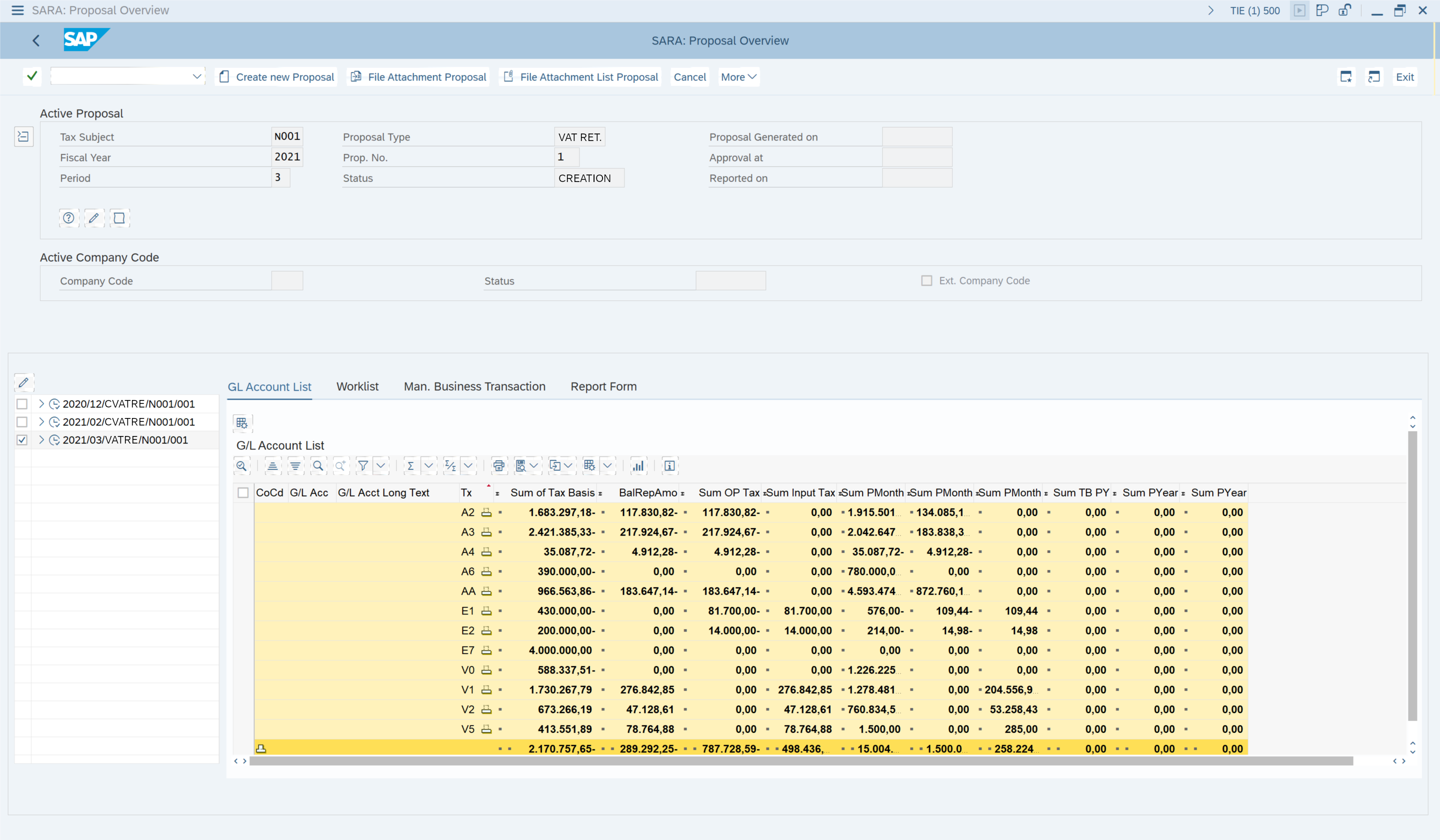

Overview of all reporting data

SARA imports all data, presents an overview of postings by G/L account and tax code with comparative dataand includes a link to posted documents in the ERP. Plausibility checks are also performed, allowing for a detailed review to begin.

Declaration form per tax group and company code

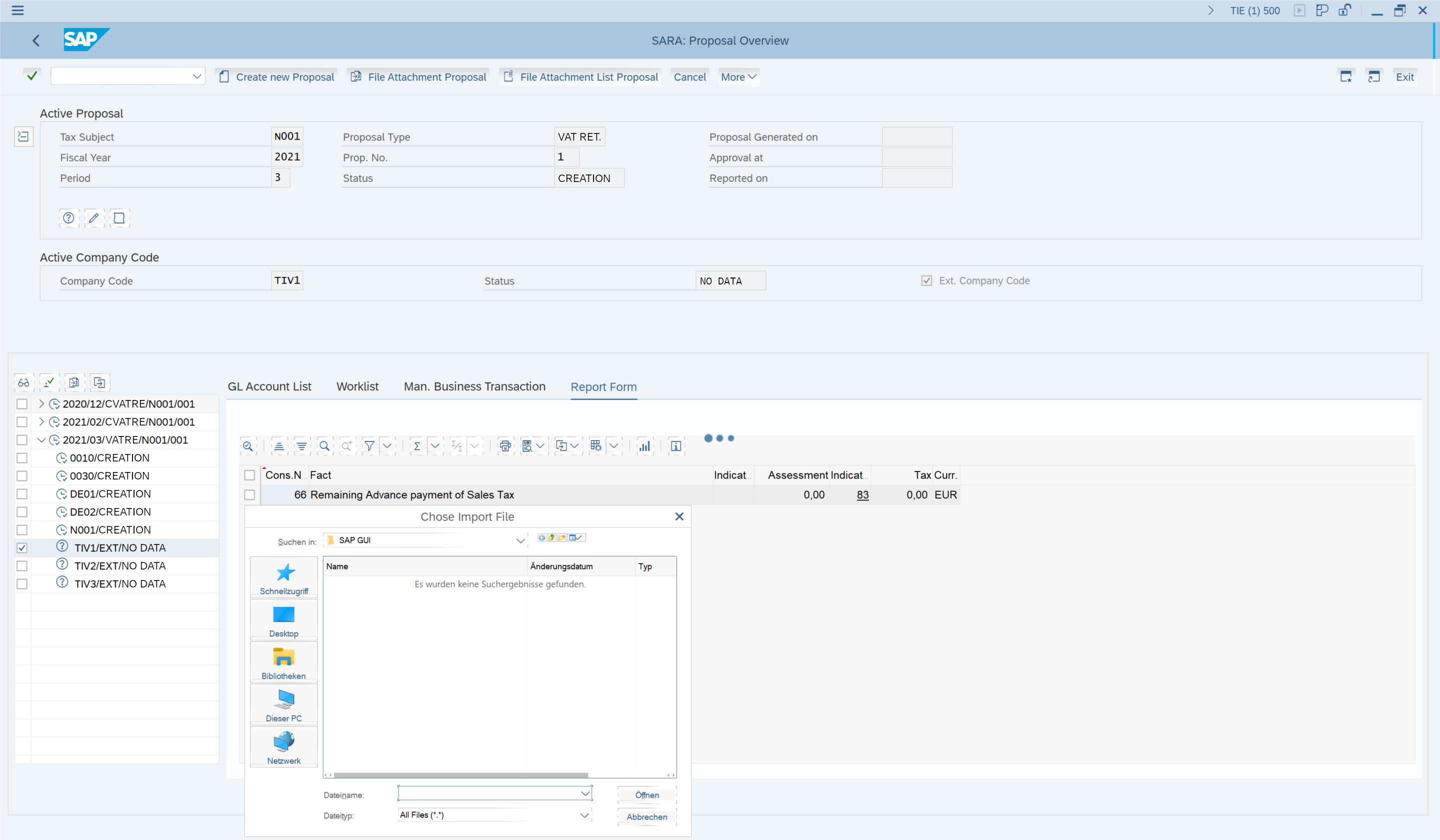

Upload of reporting data from other systems

SARA allows companies to consolidate their data from various ERP systems, including SAP, DATEV, and third-party tax consultants, into one central system for easy management. This allows the import of data on a single document or aggregated level.

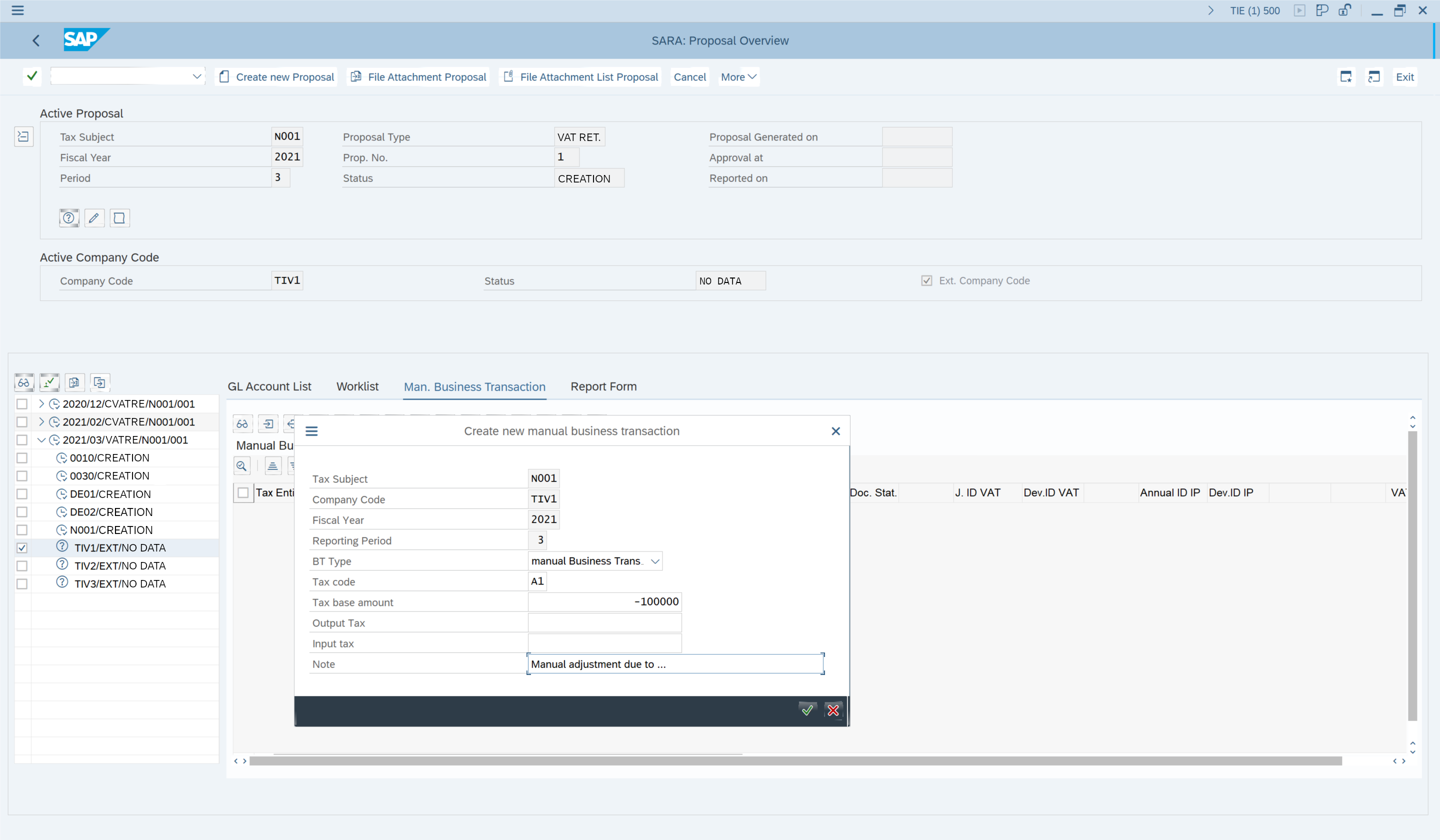

Manual adjustments

The tax department can make manual adjustments or enhancements to existing postings beyond the data in SAP, ensuring that the amounts declared are always accurate from a tax perspective.

Transmission of the declaration with one click in SAP

SARA offers a versatile range of options for the efficient transmission of declaration data to tax authorities. The preferred method is through the SARA interface, which enables the seamless transfer of the data directly from within the SAP system. Additionally, clients can also utilize already existing interfaces within their SAP system or third-party tools.

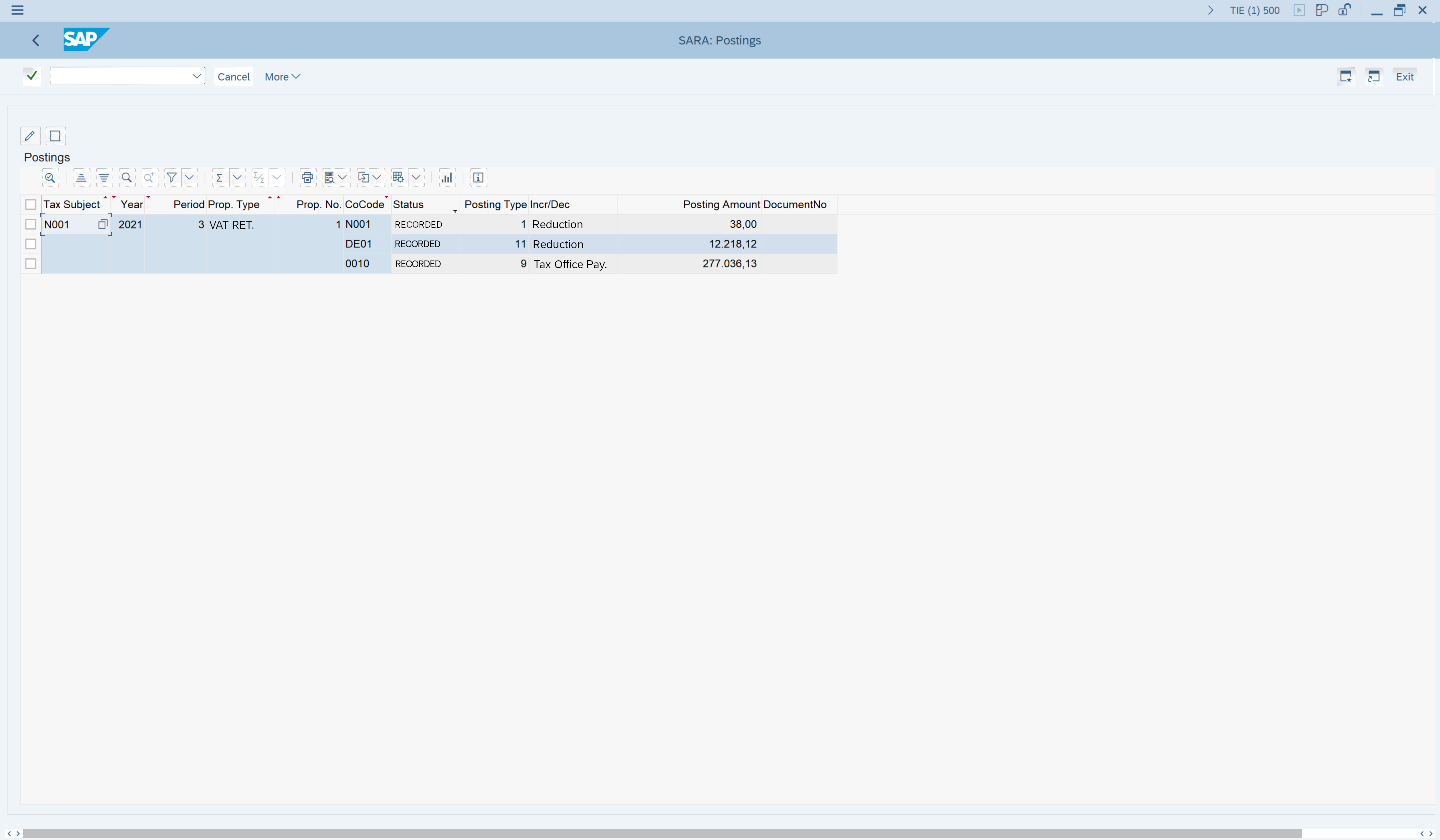

Post declaration postings

If adjustments made during the declaration process impact the tax payable accounts of various company codes, SARA promptly executes the necessary clearing of amounts. Additionally, SARA provides the corresponding FI postings via direct import.

Contact

Miklós Hegybiró

Managing Director

IKOR Products GmbH

info-products@ikor.one

+49 40 8199442-0

Miklós Hegybiró

Managing Director

IKOR Products GmbH

info-products@ikor.one

+49 40 8199442-0

Nicolas Weisensee

Mission Lead SARA

IKOR Products GmbH

info-products@ikor.one

+49 40 8199442-0

More Products

StepStream

StepStream is an established, scalable solution with an extensive customer base - focussed on the insurance...

Read moreRelated Content